Central Bank, the Fraud Detection Specialists

At Central Bank, we diligently work, every day, to help our customers avoid being the victims of fraud or scams – through tools, programs and an extensive fraud detection training program offered to our employees.

Central Bank is always watching out for you

Here are just a few of the tools we offer to help your funds stay safe and secure.

CentralNET – SecureNow, the behind-the-scenes security, keeps your login credentials and account information safe by reviewing anomalies and requires a onetime passcode or presents a challenge question when necessary. In addition, account and settings alerts can be set up for delivery to your phone or email.

CentralMOBILE – Offers the same security features as CentralNET.

Cards – A free tool within CentralNET and CentralMOBILE that gives you control over when, where and how your Central Bank debit card is used – even if it’s lost or stolen. You can view detailed debit card transaction information to ensure you know how your card is being used, and you can even enter travel plans to ensure your card will work while you're out of town.

Visa® Premium Alerts – Receive real-time1 text or email alerts when your card is used to make a purchase.2 You can also turn your card on or off if it’s lost or stolen.

Visa® Zero Liability Fraud Protection – Safeguards your card or card number if is either lost or stolen. No need to sign up – this is a standard feature of your Central Bank Visa® Credit Card.

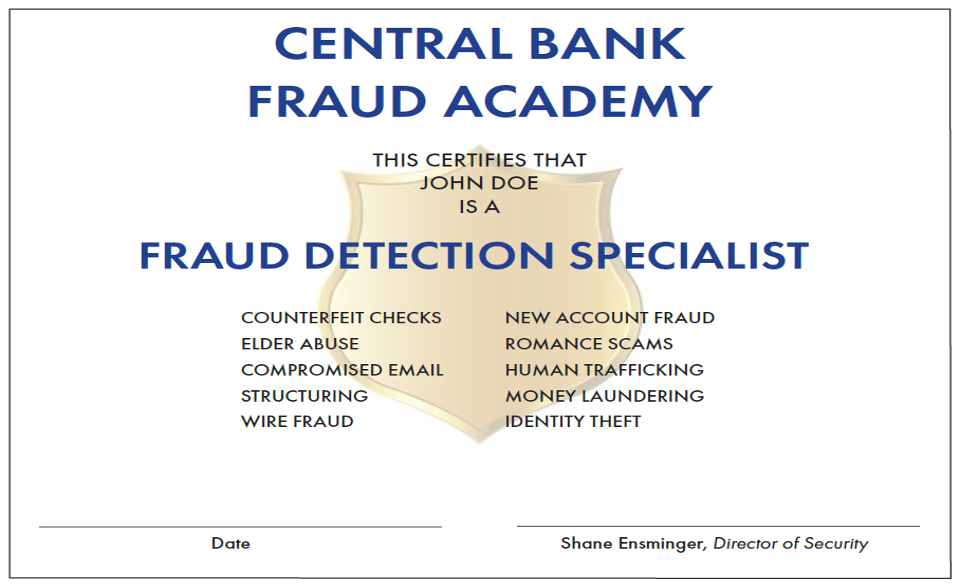

Central Bank’s Fraud Detection Academy

Central Bank recognizes fraud as a top concern and created a unique program to address this by educating and certifying our staff as Fraud Detection Specialists through the Central Bank Fraud Academy.

The Academy is a five-week training program designed to educate our staff on how to protect our customers against scams and fraudulent activity. Our instructors are financial crimes experts from within the bank and guest instructors from local and federal law enforcement agencies. Upon successful completion of the academy, our employees are certified as fraud detection specialists in the areas of counterfeit checks, elder abuse, romance scams and many other common fraud schemes.

We take protecting our customers very seriously, and we’re proud to say we proactively provide this extensive training program to our employees.